fresh start initiative expires

The IRS Fresh Start s a bit of a win-win --- the initiative makes it easier for individual and small. Jessica Santos - Garden City NY.

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

While there have been changes to IRS procedures after the Fresh Start Initiative was enacted these have generally only served to expand the benefits of the Fresh Start Initiative.

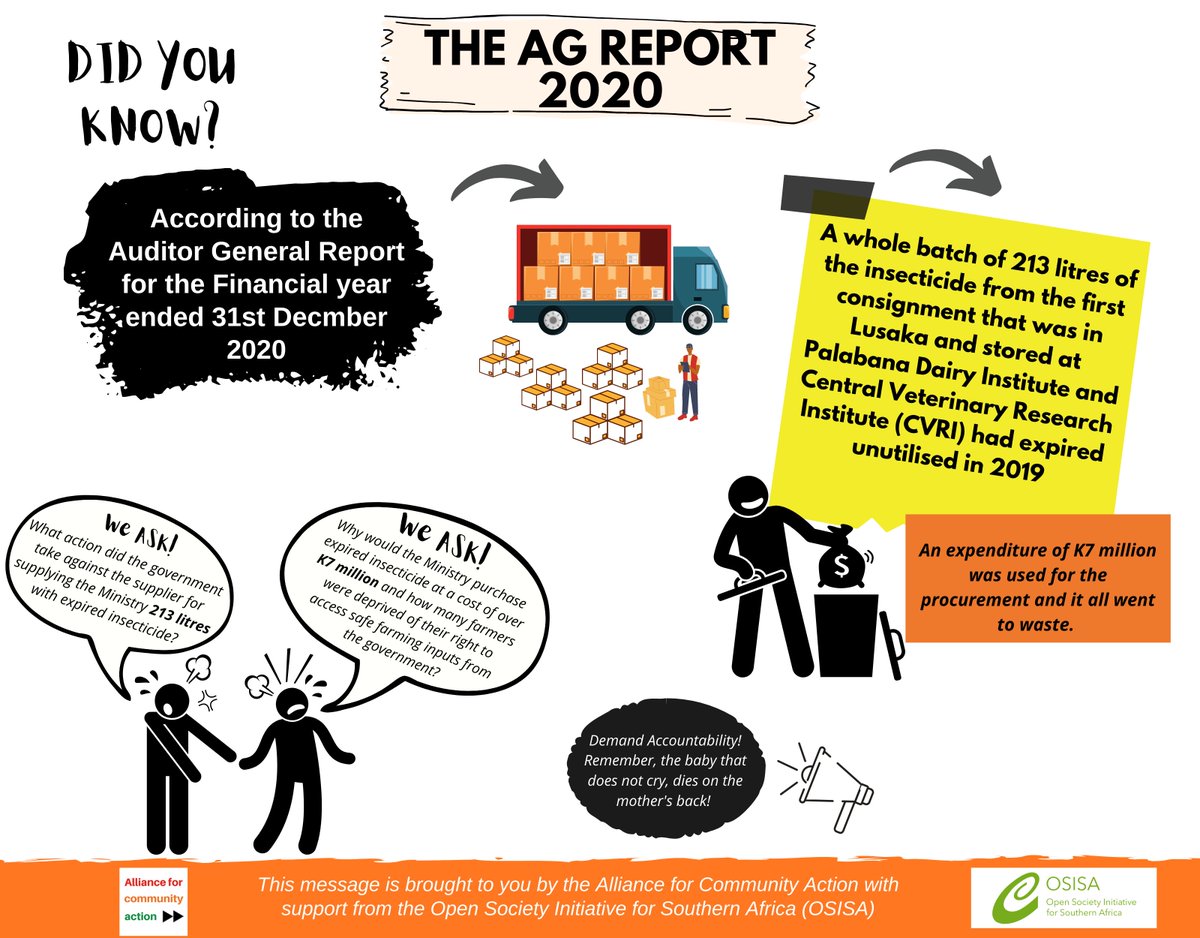

. I needed a second chance. IRS Fresh Start Program Simplifies Many Things For Taxpayers. The IRS launched the Fresh Start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing.

The Fresh Start program is a channel for debt forgiveness not a one-size-fits-all option. It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. Our mission is to help you restore your life.

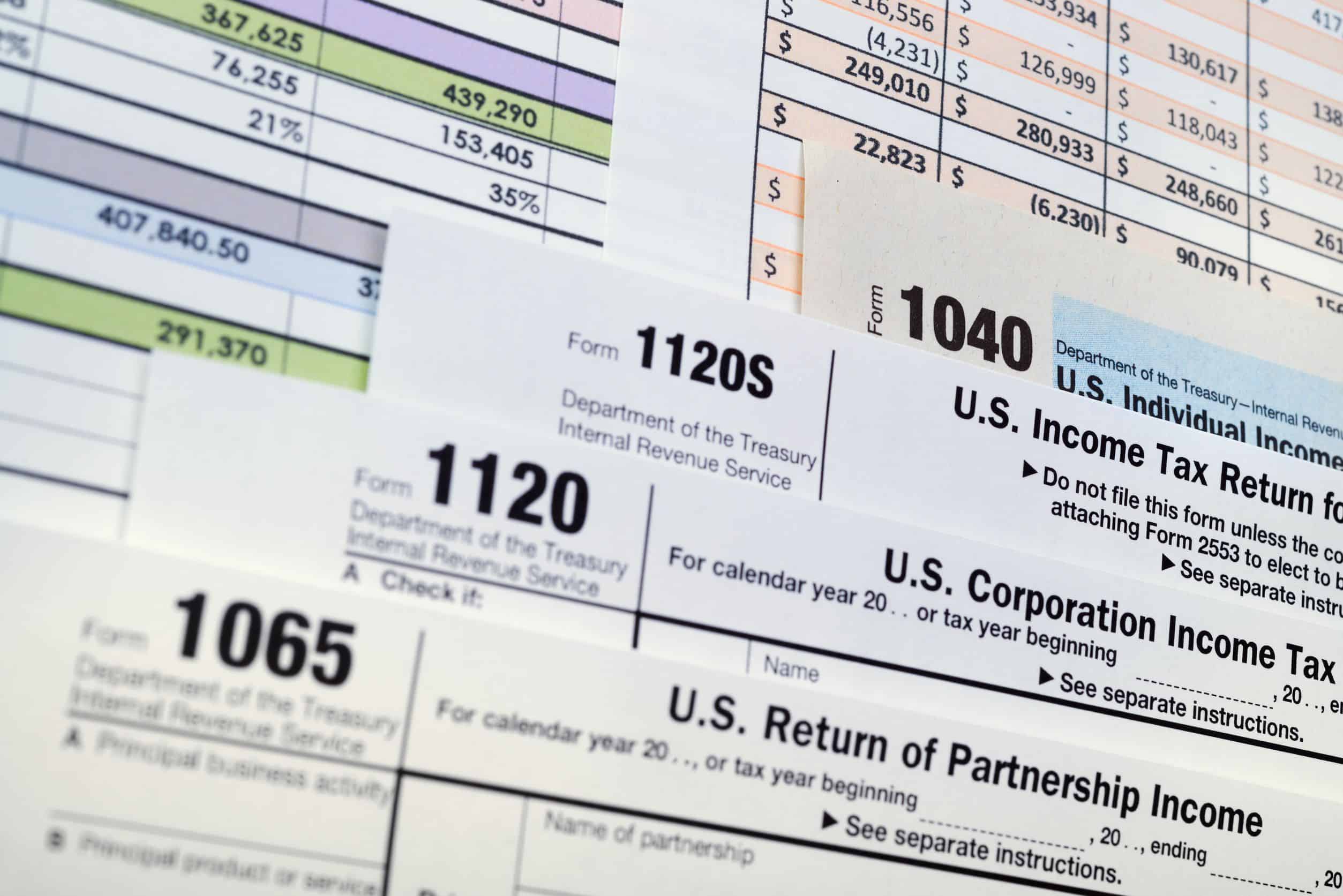

The debt must be paid off within 5 years 60 months or before the CSED Collection Statute Expiration Date expires whichever occurs first. Concentrate on the Local Market for a Fresh Start Initiative. IRS Installment Agreements.

IRS Installment Agreements and Fresh Start. Read and understand all terms prior to enrollment. Generally payments are made until the IRS statute of limitations on collections expires.

The IRS is a fearful agency but they understand that they need to offer taxpayers the opportunity to pay what they can afford while still allowing the taxpayer to care for their needs. FREE CONSULTATION NO OBLIGATION. A program to forgive a persons tax debt.

If the offered amount is to be paid in 6 to 24 months the monthly disposable income is calculated over a twenty-four. Can pay the outstanding tax liability within 60 months or before collection statutes expire. Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes.

Tax reduction programs under federal law provide real relief but they can be very complexed to navigate. Many people wonder if the Fresh Start Initiative is still in place today in 2019. The IRS Fresh Start Program isnt just for your benefit.

A program at all. When the IRS has such a relentless hold on your life its easy to feel utterly powerless. So without further ado here are 7 ways to transform your business and give it a fresh start this spring in 2022.

Its also vital that you refrain from adding any additional tax debt which. Program does not assume any debts nor provide legal or tax advice. It is for the IRS.

What Changes Did the IRS Make with the FSI. Most recently in 2018 the IRS implemented a pilot program that provided a streamlined pathway toward resolving a personal tax liability of 50000 to 100000 with an Installment Agreement that paid the liability in the lessor of 7 years or the Collection Statute Expiration date. The term Fresh Start Initiative is more fitting than Fresh Start Program since the Fresh Start Initiative isnt a new program that stands separately from existing tax laws.

The Fresh Start Program is a collection of changes to the tax code. BEFORE FRESH START INITIATIVE EXPIRES. The program emphasizes facilitating.

I used the Fresh Start Program to buy the perfect car for me. Youll need to explore the specific opportunities that may apply in your case. Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels.

In-Business Trust Fund installment agreements. Under the new rules the IRS does not issue tax liens if the tax owed is less than 10000. Everyone is hoping for the pandemic to end by next year.

Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans. This is to help willing taxpayers pay off debts without any undue financial hardship. This pilot program was initially set to expire in September 2018 but.

Thanks to the Fresh Start Program it is now easier for taxpayers to qualify for a streamlined IRS installment agreement. The payment option may be as long as 72 months or six years. Instead its an initiative that changed numerous elements of the tax code.

While on the installment agreement the IRS mandates on-time monthly payments. Their platform is completely free to use and offers a no-risk consultation. That said anyone who owes a tax debt of 50000 or less to the IRS will almost certainly be qualified to initiate repayment under the Fresh Start initiative.

If youre experiencing or worried about liens levies garnishments or more now is the time to learn about your options to protect yourself and resolve your tax burden. Some magical bullet to simply give the IRS a fraction of the tax debt or pennies on the dollar and call it good. GET A FREE TAX QUOTE.

Learn more about the IRS Fresh Start Program here. Note that there are rare exceptions to this rule. Check Your Eligibility for The IRS Fresh Start Program.

Not available in all states. However the future is. A tax lien will be filed with this type of agreement unless the debt is under 10000.

The program is designed to help individuals and small businesses with overdue tax liabilities and it also has the benefit of helping the IRS by removing taxpayers from its vast collection inventory. In-business trust fund installment agreements are for debts of no more than 25000. The reason is that the Fresh Start Initiative changed IRS collection policy to lower the total number of months of income provided to the IRS from 48 to 12 months if the offered amount would be paid off in 5 months or less.

4 5 Very good Fresh Start Initiatives goal is to help consumers restore control over all of their IRS tax debt issues. Propose to pay off your tax debt within the Collection Statute Expiration Date which basically means you will pay it off before the tax debt expires and the IRS will accept the payment plan. So in short the Fresh Start Initiative is still in place in 2019.

The changes made as a part of the Fresh Start Initiative were designed to help. The primary provisions of the program included the following. The service was established in 2014 and since then has served over 1 million visitors.

The FSI increased the tax debt threshold at. IRS Fresh Start Qualification Assistance. The Fresh Start Initiative can also help shield you from bank levies or wage garnishments.

As an online aggregator Fresh Start.

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Check Expiry Date Of Windows 10 Insider Preview Build Tutorials

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Bankruptcy Fresh Start Program The What And Why Day One Credit

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Bankruptcy Fresh Start Program The What And Why Day One Credit

Greenyard Annual Report 2020 2021 By Greenyard Issuu

The Irs Tax Debt Forgiveness Program Explained

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Bankruptcy Fresh Start Program The What And Why Day One Credit

How To Find Csed Irs Wilson Rogers Company

Bankruptcy Fresh Start Program The What And Why Day One Credit

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt